Course Curriculum

Master Bankruptcy Marketing: Attract High-Value Clients, Build a Profitable Practice, and Become the Go-To Expert in Your Market

It’s time to build a bankruptcy practice that attracts the right clients — consistently and profitably. this marketing course empowers your sustained growth.

- Define Your Niche & Ideal Clients

→ Identify who you serve best and how to speak directly to their needs. - Leverage Strategic Partnerships

→ Discover who already has access to your ideal clients — and how to connect with them. - Craft a Memorable Tagline

→ Create messaging that sticks and positions you as the solution. - Build a Business That Works for You

→ Structure your practice for efficiency, scalability, and profitability. - Develop a Brand Identity That Builds Trust

→ From logo to tone, make your brand instantly recognizable and credible. - Launch a High-Converting Website

→ Your digital storefront should educate, engage, and convert visitors into clients. - Set Up Marketing Channels That Deliver

→ Learn which platforms work best for bankruptcy and how to use them effectively. - Create Marketing Projects That Fit Your Style

→ Whether it’s webinars, email campaigns, or local outreach — find what works for you. - Establish Office Infrastructure That Supports Growth

→ Tools, systems, and workflows that keep your practice running smoothly. - Draft Engagement Agreements & Intake Forms That Convert

→ Make onboarding seamless and professional. - Network Like a Pro & Build Referral Relationships

→ Learn how to become the attorney others recommend.

$179

Master Chapter 7 Petitions: A Practical, Step-by-Step Guide

In today’s dynamic legal landscape, precision and efficiency in Chapter 7 filings are paramount. This course goes beyond theoretical knowledge, offering practical, step-by-step guidance that you can implement immediately

- Acquire Essential Getting-Started Resources → Receive a comprehensive checklist of tools and guides to launch your practice efficiently.

- Network Strategically with Other Attorneys → Discover proven methods to build your referral base and secure a steady stream of clients.

- Master the Tools of the Trade & Software Selection → Learn document management and choose the right software to maximize your profitability.

- Navigate PACER, ECF, and Local Court Systems → Master electronic filing and court procedures to ensure local compliance and efficiency.

- Master the Art of Debtor Pre-Qualification → Develop a reliable screening process to identify the optimal chapter for every client.

- Execute the Strategic Chapter 7 to 13 Conversion → Acquire the precise legal steps to successfully flip a Chapter 7 into a superior Chapter 13 filing.

- Overcome the Means Test Conflict → Develop arguments and methods to successfully justify a Chapter 13 plan.

- Petition Preparation: Schedules A-J & SOFA → Confidently complete every schedule and financial form to ensure a flawless filing.

- Strategically Utilize Reaffirmation & Redemption → Advise clients on securing or clearing liens to retain or liquidate secured assets.

- Debt Classification Mastery (Inside/Outside Plan) → Determine optimal claim placement to control plan length and client payments.

- Optimizing Chapter 13 Plan Payments → Command the rules for using fixed versus prorata payment methods for confirmation.

$699

Advanced Bankruptcy Law: Strategy, Conversion, and Complex Debt Management

- Mastering the Art of Chapter 13 Debtor Qualification → Learn the criteria and screening process to confidently guide debtors into the optimal Chapter 13 plan.

- The Strategic Conversion: Executing a Chapter Flip → Acquire the precise legal and procedural steps to successfully convert a less-favorable Chapter 7 into a superior Chapter 13 filing.

- Overcoming the Means Test Conflict: Justifying Chapter 13 Eligibility → Develop arguments and methods to successfully secure a Chapter 7 plan even when the Means Test initially points to Chapter 13.

- Debt Classification Mastery: Strategically Placing Claims Inside or Outside the Plan → Determine the optimal placement of claims (secured, priority, or unsecured) to control plan length and client payments.

- Advanced Strategies for Managing Long-Term Debt in Chapter 13 → Learn how to effectively handle ongoing obligations (mortgages, car loans) to ensure plan success and client retention of collateral.

- Optimizing Plan Payments: Applying Fixed vs. Prorata Debt Structures → Command the rules for using fixed versus prorata payment methods to construct feasible and court-confirmable Chapter 13 plans.

$1899

Petition Mastery: Executing Flawless Chapter 7 and Chapter 13 Filings

Initiate the Voluntary Petition with Precision → Learn the critical first steps and timing to secure the automatic stay and officially commence the case.

Accurately Inventory Assets: Schedules A & B → Master the detailed reporting of all personal property and real estate to ensure full disclosure and compliance.

Maximize Client Protections: Schedule C (Exemptions) → Strategically apply federal and state exemption laws to shield your client’s assets from creditors.

Delineate Secured Creditors: Schedule D → Confidently list and classify all secured debt to lay the groundwork for collateral treatment in the plan.

Identify and Prioritize Debts: Schedule E → Accurately categorize all priority debts (like taxes and domestic support) to ensure correct plan treatment.

Account for All Unsecured Claims: Schedule F → Systematically list all unsecured non-priority creditors to ensure their discharge upon completion.

Manage Contracts and Leases: Schedule G → Determine whether to assume or reject contracts and unexpired leases, protecting your client’s interests.

Identify Co-Debtor Liability: Schedule H → Properly disclose all co-debtors to inform the court and manage joint liabilities.

Calculate Accurate Client Income: Schedule I → Master the rules for reporting all sources of income to establish the foundation for the Means Test and the plan.

Detail Client Monthly Expenses: Schedule J → Learn how to truthfully and accurately report monthly expenditures to determine feasibility of the repayment plan.

Complete the Comprehensive Statement of Financial Affairs (Form 107) → Navigate the complex questions on the client’s financial history to ensure full transparency and avoid scrutiny.

Execute the Statement of Intentions (Form 108) → Precisely state the client’s intentions regarding secured collateral (reaffirm, redeem, or surrender) to comply with Chapter 7 requirements.

Determine Eligibility with the Means Test (Form 122C) → Confidently calculate current monthly income to determine Chapter 7 eligibility or plan payment obligations in Chapter 13.

Configure the Chapter 13 Plan for Confirmation → Master the structural requirements for a plan that is feasible, compliant, and ready for court approval.

Establish Clear Attorney Compensation → Learn the guidelines for disclosing and obtaining court approval for your fees, ensuring predictable firm revenue.

Execute Vehicle Cramdowns Within the Plan → Apply the relevant rules to reduce vehicle loan balances to the collateral’s value, lowering client payments.

$1199

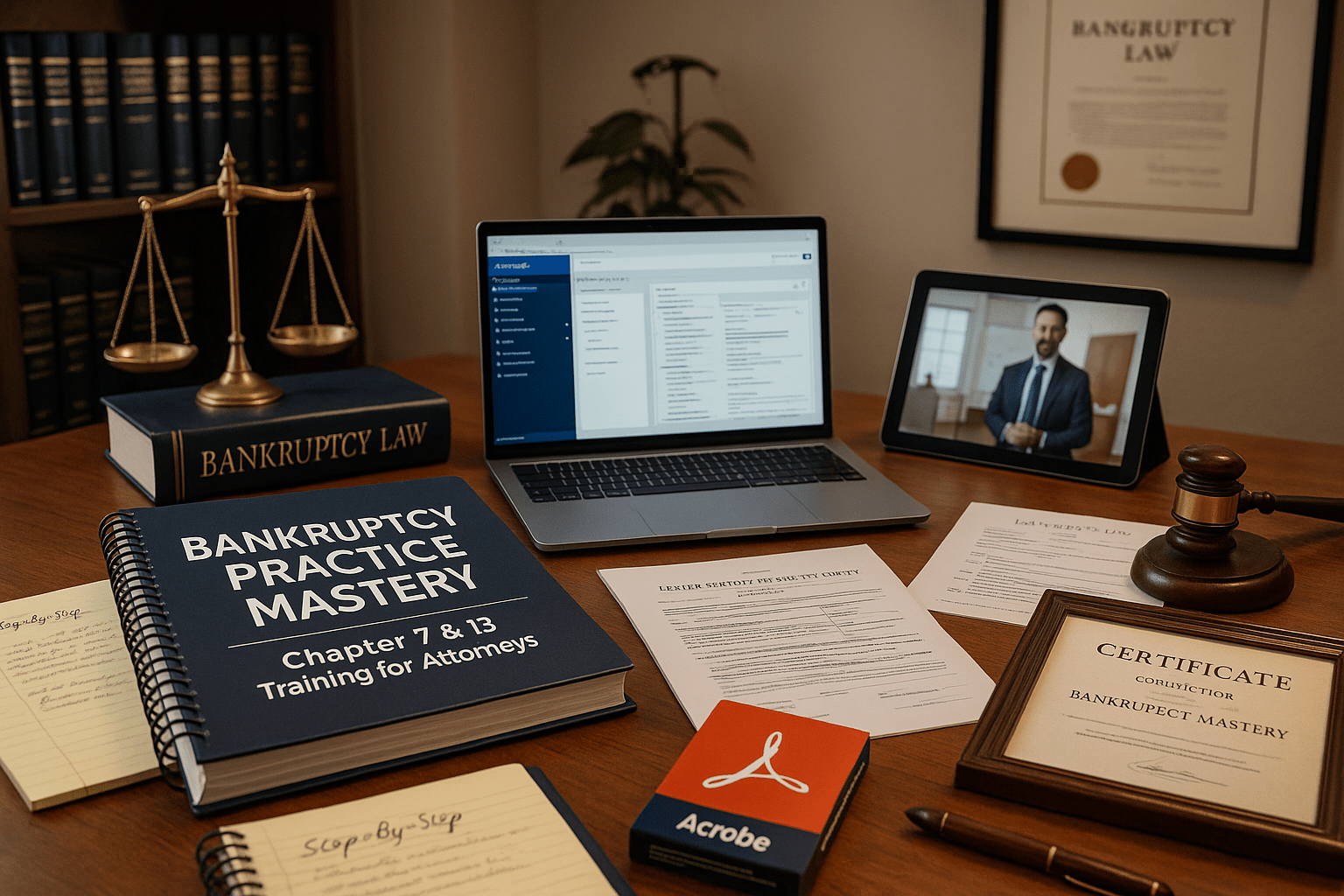

Chapter 7 & 13 Foundations: Launch Your Practice with Confidence and Precision

Are you looking for a step-by-step roadmap to mastering the entire bankruptcy filing process? It’s time to gain the foundational knowledge and practical tools needed to confidently handle any Chapter 7 or Chapter 13 case from start to finish.

Launch or expand your bankruptcy practice with the most comprehensive, practical training available for Chapter 7 and Chapter 13 filings. This foundational course is your step-by-step guide to mastering the entire bankruptcy process, from initial client intake to final petition filing. We demystify the complexities of locating crucial bankruptcy statistics, provide you with essential getting-started resources, and offer proven strategies for networking with other attorneys to build your referral base. Learn the art of pre-qualifying debtors, navigate the PACER and ECF systems with ease, and gain an insider’s understanding of your local bankruptcy court. We even cover the essential “tools of the trade,” including Adobe Acrobat and a guide to selecting the right bankruptcy software. This is the ultimate, all-in-one resource for building a successful and profitable bankruptcy practice. Start your journey to bankruptcy mastery today and gain the confidence to handle any Chapter 7 or 13 case.

- Locate and Utilize Crucial Bankruptcy Statistics → Learn where to find reliable data to validate your practice area and inform your business strategy.

- Acquire Essential Getting-Started Resources → Receive a comprehensive checklist of tools, guides, and initial steps to launch your practice efficiently.

- Network Strategically with Other Attorneys → Discover proven methods to build your referral base and secure a steady stream of clients.

- Master the Art of Debtor Pre-Qualification → Develop a reliable screening process to identify the right chapter for every client, ensuring smooth case flow.

- Bypass the “Rapid Import Deception” → Understand common pitfalls in data management so you can avoid costly errors and incomplete filings.

- Secure Your PACER Account Access → Get a clear, step-by-step guide to accessing court records and conducting necessary due diligence.

- Obtain Your ECF Filing Number → Navigate the attorney enrollment process to gain electronic filing privileges with your local court.

- Navigate Your Local Bankruptcy Court System → Gain an insider’s understanding of court procedures and personnel to ensure local compliance and efficiency.

- Master the Tools of the Trade: Adobe Acrobat → Learn essential PDF and document management techniques to streamline your petition preparation.

- Select the Right Bankruptcy Software → Get an unbiased guide to choosing software that meets your needs and maximizes your practice’s profitability.

$1199